Bankruptcy Attorneys in Hoboken , NJ

Bankruptcy Attorneys serving Hoboken

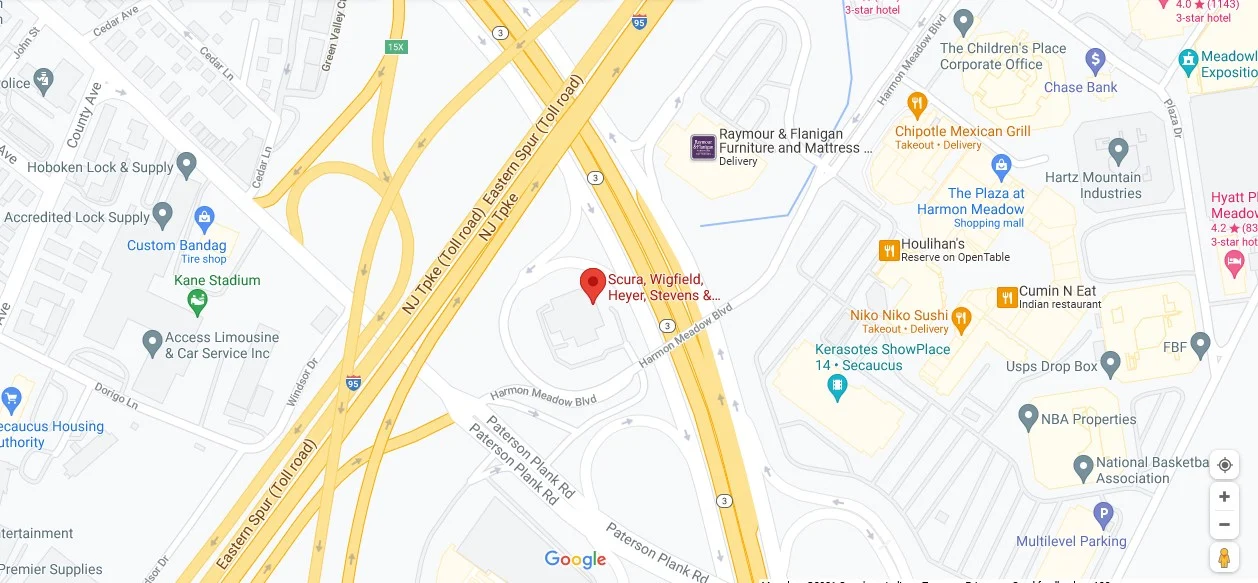

Are you looking for a bankruptcy law firm in Hoboken? If so, the bankruptcy attorneys of Scura, Wigfield, Heyer, Stevens & Cammarota encourage you to take advantage of a free consultation to learn how we can help you explore debt relief options that can help you get out of debt now.

We have assisted individuals, spouses, and businesses in Hoboken since 1972 file for bankruptcy relief under Chapter 7, Chapter 13, and Chapter 11 of the Bankruptcy Code. Our bankruptcy lawyers have extensive experience handling bankruptcy cases. When you need a trusted, compassionate, skilled legal advocate who places your best interests first, Scura, Wigfield, Heyer, Stevens & Cammarota is the right Hoboken bankruptcy law firm for you.

Why Should I File a Bankruptcy Case?

It can be difficult to know whether bankruptcy is right for you until you consult an experienced Hoboken bankruptcy attorney. Filing for bankruptcy relief gets rid of debts quickly and affordably. However, filing a bankruptcy case is a serious matter. You should not jump into a Chapter 7 or Chapter 13 case without weighing all debt relief options.

Some of the common reasons why people need to file for bankruptcy relief include:

- Unable to pay medical expenses incurred because of a sudden illness or accident;

- Decrease in income from unemployment, downsizing, disability, workplace accident, or retirement;

- Loss of a family member because of death or divorce;

- Creditor harassment, including threatening letters, visits from debt collectors, and constant telephone calls;

- Loss of a business or decrease in business income;

- Depleting retirement funds or using a home equity loan to pay debt payments;

- Foreclosure, repossession, debt collection lawsuits, wage garnishments, and asset seizure; and,

- Using credit cards to pay for basic living expenses such as rent, food, and utilities.

The reasons why people file a bankruptcy case are as numerous and unique as the clients we represent. Our Hoboken bankruptcy attorneys meet with each client to discuss their individual financial situation to determine if filing a bankruptcy case is the best solution for their debt problem.

We conduct a thorough review of your income, assets, debts, and financial transactions to analyze how filing a Chapter 13 or Chapter 7 would help improve your financial situation. We also review non-bankruptcy options to help you weigh the pros and cons of bankruptcy. After your consultation, you have the information necessary to make an informed decision about whether bankruptcy is right for you.

The Scura Difference

At Scura, Wigfield, Heyer, Stevens & Cammarota, our core beliefsfocus on our desire to help people. We believe good people face difficult and challenging circumstances. However, there are options that can help you get out of debt. You can have the fresh start that you need to recover after a financial crisis. We desire to help you be in a better financial position once your bankruptcy case is complete then you were when you first contacted our Hoboken bankruptcy law firm.

The Scura difference is simple — we are 100 percent focused on our clients’ needs. We do not expect you to understand bankruptcy law or how to complete bankruptcy forms. That is our job. We only ask that you work with us to gather the necessary information needed to complete the bankruptcy forms. Our legal team takes care of the rest. We understand you are under enormous stress. We do not want to add to that stress. Instead, we want to make the process of filing for bankruptcy relief as stress-free as possible.

Choosing Between Chapter 7 and Chapter 13

Most individuals file under Chapter 7 or Chapter 13 of the Bankruptcy Code. A Chapter 7 case is referred to as a liquidation bankruptcy. Don’t worry! That does not mean that you are going to lose any property when you file under Chapter 7. Bankruptcy exemptions protect your property from the court and the trustee. Most people who file a Chapter 7 case do not lose any of their property. However, it is best to consult with an experienced Hoboken bankruptcy attorney before filing for Chapter 7 relief to determine if you may have property that would be at risk if you file under Chapter 7. In most Chapter 7 cases, individuals get rid of all, or most, of their unsecured debts within four to six months after filing their Chapter 7 bankruptcy petition.

Chapter 13 is referred to as a wage earner plan. Under Chapter 13, you repay some of your unsecured debts through a Chapter 13 bankruptcy plan. Many people pay a small fraction of what they owe to credit card companies, medical providers, and personal loan companies. You can save your home, vehicle, and other property by filing a Chapter 13 bankruptcy case.

Also, a Chapter 13 case allows you to repay debts that are non-dischargeable (taxes, alimony, child support, etc.) over a 60-month plan to avoid tax liens, seizures, and contempt charges. In many cases, people lower loan payments on their vehicles. Some individuals pay less to satisfy the lien on their vehicles through Chapter 13.

Filing a bankruptcy case has many advantages. You can learn more about bankruptcy advantages and the bankruptcy process during your free consultation.

Contact a Hoboken Bankruptcy Attorney to Learn More

We have a great deal of bankruptcy information on our website, but we hope you will take advantage of our free consultation with a bankruptcy lawyer in Hoboken to learn more about your debt relief options.

Call 973-786-1582 to speak with a knowledgeable representative. You may also use our online contact form or chat with a representative online to request additional information.

About Hoboken, New Jersey

The ,City of Hoboken is located in Hudson County, New Jersey, on the Hudson Waterfront. A large portion of the city is involved in industries that support the Ports of New Jersey and New York. Hoboken offers residents and visitors an abundance of attractions, including shopping, dining, museums, music events, and entertainment venues. With a rich history that dates back to 1784 when Colonel John Stevens purchased the island, Hoboken is a wonderful place to call home. Scura, Wigfield, Heyer, Stevens & Cammarota is proud to be a part of the Hoboken community.