At the Law Offices of Scura, Wigfield, Heyer, Stevens, & Cammarota, LLP, we advise our clients that to collect workers’ compensation benefits, their injury must be job related, though it’s not always...

Even a "minor" car accident can turn your life upside down. Sometimes, you walk away from a crash feeling lucky — only to realize days or weeks later that you are dealing with a serious injury. At ...

As I’ve continued to grow and gain experience as a personal injury trial attorney, I’ve come to realize that no case is perfect. However, I’ve also come to realize that meaningful value can be...

The most fundamental advice that all drivers receive from the first day they get on the road is to pay attention to the road. We all know that we need to pay attention to what other cars are doing,...

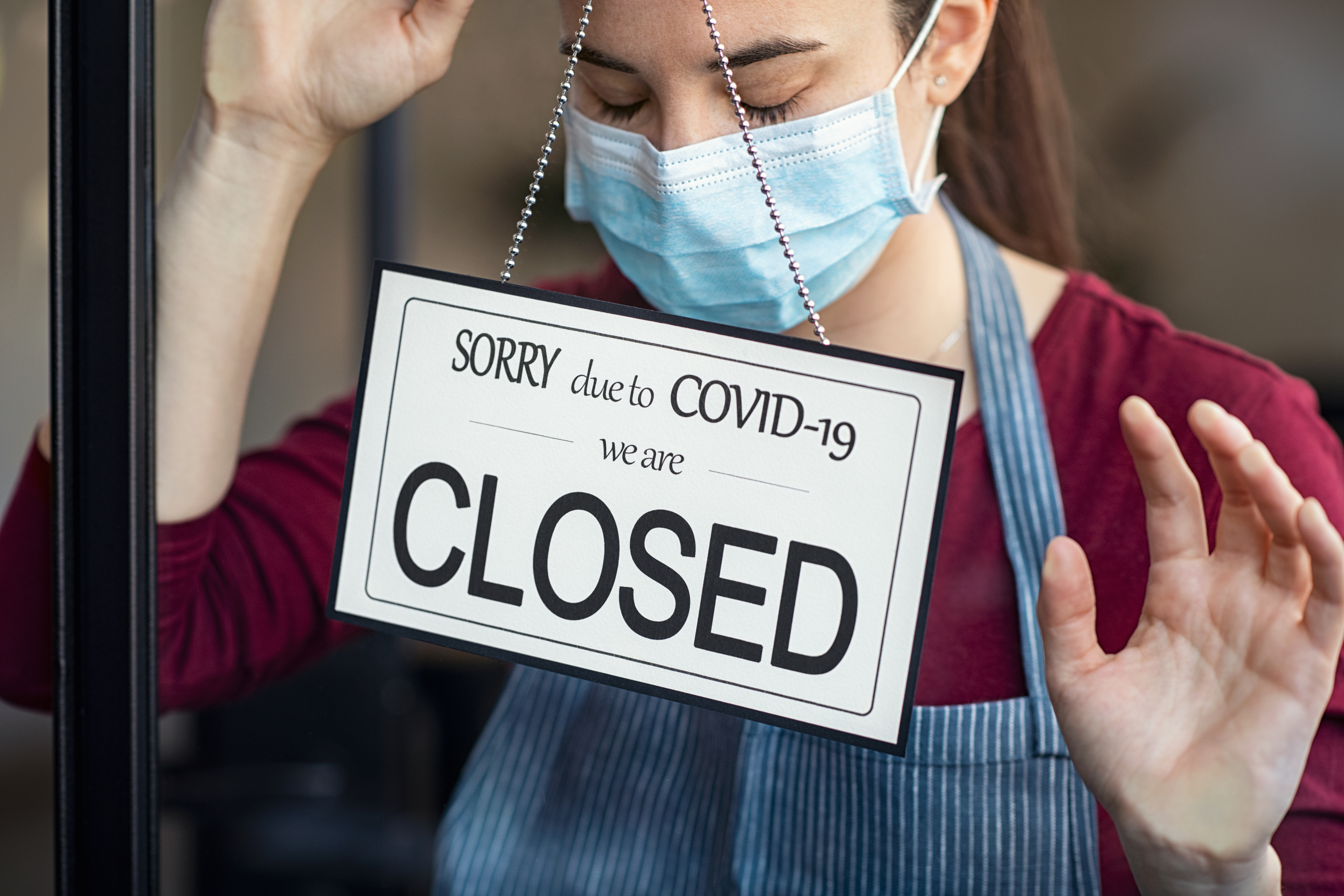

On January 30, 2023, the Biden Administration announced that the two national emergency orders for addressing the COVID-19 pandemic will end on May 11, 2023. The first emergency order was a public...

Introduction and Facts of Case

In a recent decision by the New Jersey Supreme Court, it determined “the standard of care that should apply to a coach’s decision to allow a high school field hockey...

In New Jersey, pursuing a personal injury claim when an individual is a minor is substantially different then seeking compensation for injuries when the victim is an adult. As minors, children do not...

Generally, when individuals decide to start a business, one of the first task to complete is to incorporate the business and determine what type of business entity is best for their company. These...

On February 17, 2021, the New Jersey Supreme Court in Maison v. New Jersey Transit Corporation, et al. issued an opinion that heightened the standard of care owed to passengers on the New Jersey...